This is a tough one. Why? Because it is only by working with an advisor over some time that you really know whether the relationship will meet your expectations. There are subjective personal and professional issues at stake besides the technical issues. That said here are some tips to help you whittle the selection process down.

Credentials are an easy start. Some are better than others; something is usually better than nothing. I suggest you get the advisor’s card, go home and Google the letters after the name. The more comprehensive the required courses, the completion of a board test, adherence to a code of ethics/standards, and continuing education requirements, all indicate a higher level of competence and product knowledge. Credentials indicate the advisor is interested in expanding professional knowledge and staying current. However, it doesn’t mean the advisor knows how to use all investment possibilities nor has the necessary products available for his use and your needs.

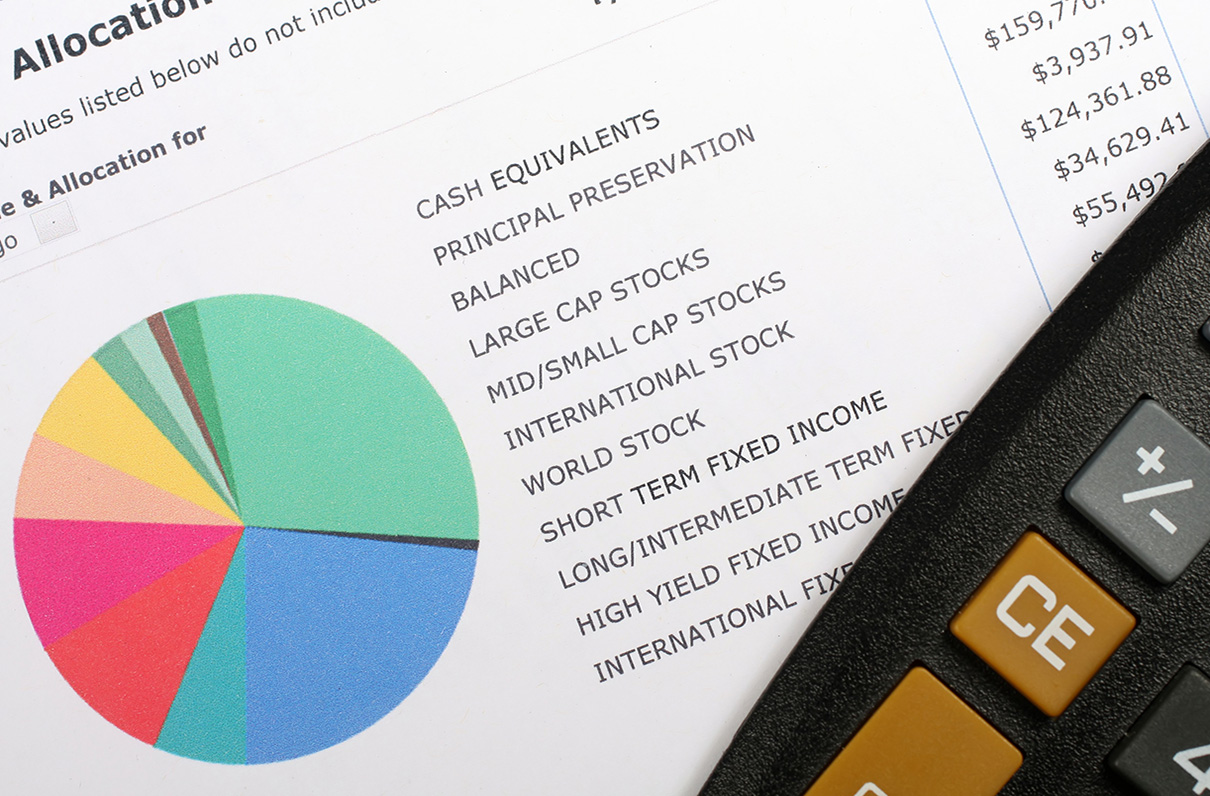

Expertise. The key consideration is the advisor’s expertise. When it comes right down to it, in the financial world there are countless ways to help a person reach their financial goals. You want someone who knows most of the possibilities, has the most investment/insurance options available to them, and will custom design a plan that best suits your personal needs and desires. You don’t want a one-trick-pony who knows only a few things or will work (in his own benefit) to make his few options work for you. You are the key piece in the relationship. Your person should be working for your benefit and have the most tools in the toolbox (and be willing and able to use them) to develop the most perfect game plan specifically for you.

Where you look matters. Generally speaking, banks tend to offer banking solutions; insurance companies offer insurance solutions, and brokers offer investment firm solutions. Bank advisors within a bank’s investment department can be more like investment firm brokers. Be wary of advisors who see annuities as the solution for most situations. An annuity is an insurance product with investments, lots of strings, and fees (not that an annuity is a bad product when used properly). Independent advisors who open accounts and manage portfolios still work through a firm that handles the accounts and investments so they may be limited by that firm’s offerings or policies. Independent advisors who offer only advice for a fee and don’t open accounts or manage your money are the most unbiased—but you have to assume a bit more work on your part.

ABC: Always Be Closing. Every advisor who opens accounts, recommends investment options and manages the buying/selling of the investments is a salesman. They have to put food on the table and please their bosses—not necessarily in that order. Their job performance is directly related to how much money they make for their company and that is related to them closing the deal with you. If one investment offers more money to their company (and them) than another, there is a natural bias. Technically, advisors are supposed to do the best thing for the client; but who’s to say what’s best? Most decisions are subjective and anything can be spun to sound like the best option for you. So when you consider a specific company to act as your advisor, think about where their greatest revenues will come from…insurance?…company specific products?…services with lots of fees? Ask them. Never be shy. A good advisor doesn’t mind explaining the details and respects a knowledgeable client.

Read Part II here.