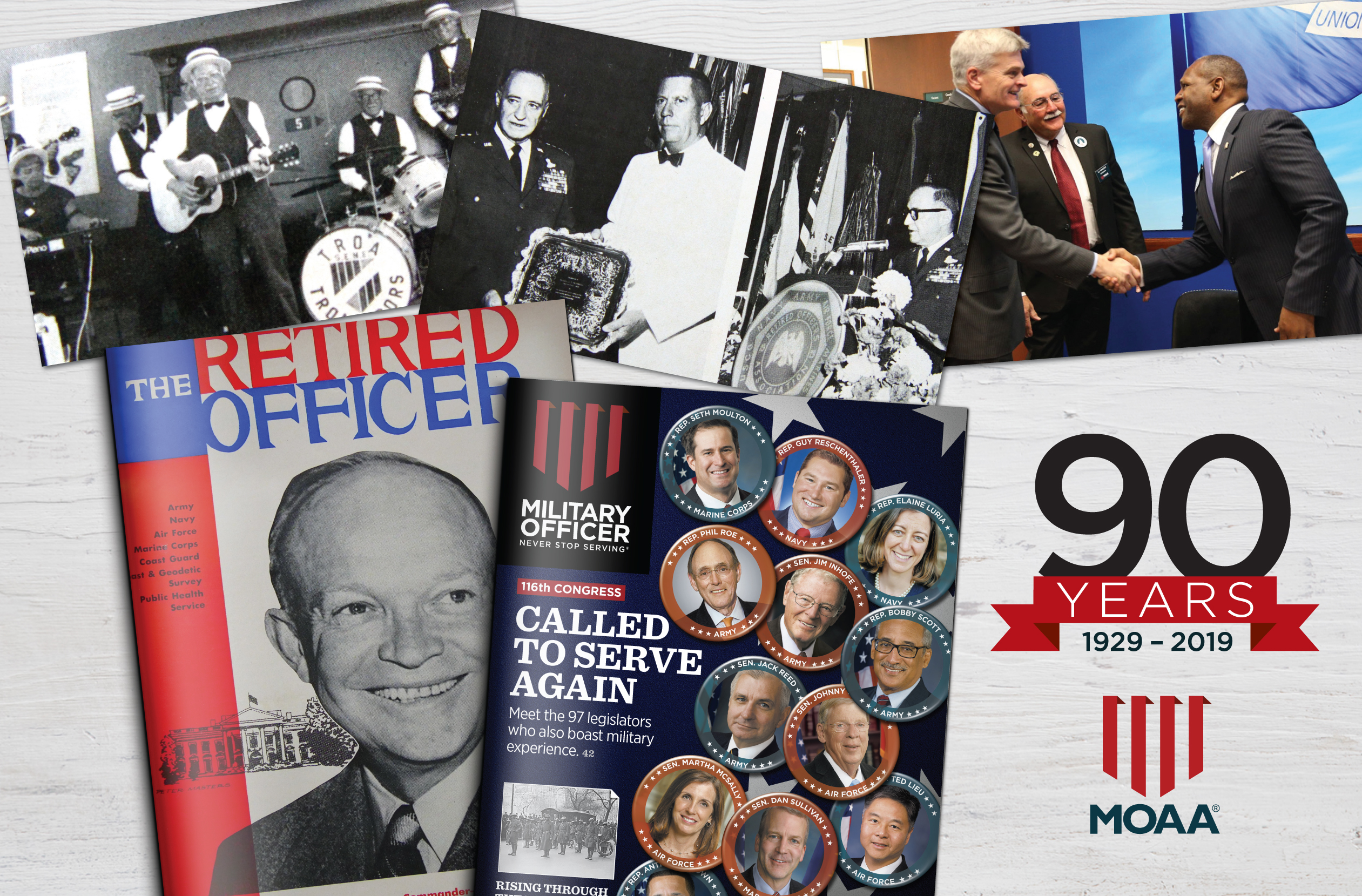

The three stories below by Kristin Davis appear in an issue of Military Officer, a magazine available to all MOAA Premium and Life members. Learn more about the magazine here; learn more about joining MOAA here.

To join the fight against the widows tax, send your legislators a MOAA-suggested letter.

And click here to read about our recent successes on Capitol Hill.

'A Very Hard Decision in a Very Difficult Time'

Retired Capt. Kathy Thorp spent 37 years as a Navy nurse. Her husband, Capt. Owen Thorp, was a graduate of the U.S. Naval Academy in Annapolis, Md., and spent two decades as a permanent military professor teaching systems engineering at his alma mater.

The Thorps received countless trainings and briefings. Yet it was only after Owen's death from a neuroendocrine cancer in 2016 that Kathy learned about the Survivor Benefit Plan-Dependency and Indemnity Compensation (SBP-DIC) offset, or widows tax.

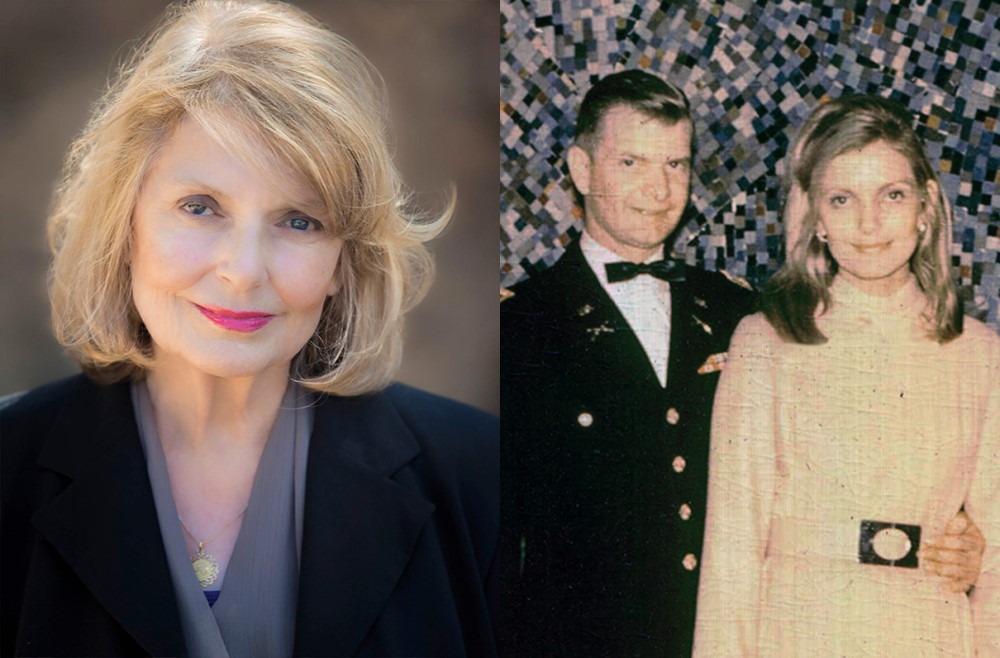

Kathy and Owen Thorp (left: photo by Mike Morones; right: photo courtesy of Kathy Thorp)

“My paperwork came in the mail,” Kathy says. “Nothing in it talks about the DIC. Nothing.”

The reality of her financial situation complicated a life already permanently altered by loss. Kathy won't get her Navy Reserve retirement until she turns 60, several years from now. “The money coming in now is not paying the bills,” she says.

Kathy later learned if her husband had retired from the military and gotten a job with the federal government, there would be no offset - she'd get both SBP and DIC. She'd also receive both if she remarries after age 57. It made no sense.

The Thorps met at Portsmouth Naval Hospital when Owen was a submariner. When he received orders to Orlando, Fla., a few months later, he proposed. They'd been married 34 years when Owen's cancer was diagnosed. Kathy knew right away it was terminal, and she left her job to care for him.

More than 1,500 mourners attended his funeral at the Naval Academy chapel, filling it to capacity. In addition to Kathy, Owen left behind four grown children - including three who joined the military - and countless midshipmen he inspired and mentored as a brilliant and beloved professor.

Kathy is trying to channel her grief and frustration into making a change. “I have a cushion to fall back on,” she says. “Many of these young widows don't.” Many widows with young children choose the SBP-child option to avoid the DIC offset. In the short-term, it's enough to get by, but once their children are no longer dependents, the SBP stops.

“You've lost your husband, and in many cases the person who has done your finances,” Kathy says. “When you don't have anybody to help you, you don't know. It is a very hard decision in a very difficult time.”

Nancy and Sean Mullen (left: photo by Steve Harman/@HARMANvisuals; right: photo courtesy of Nancy Mullen)

'He Paid Plenty. Our Country Can Do Better'

Army Warrant Officer Sean Mullen didn't plan to get married. The demanding life of a special forces soldier would be too much on a wife, he once told his parents. Then, in 2004, he met the love of his life. Within days of meeting Nancy, he called home. He'd found the one. They married in December 2005.

Sean's life meant dangerous assignments, including deployments to war zones. Sean was on his sixth deployment when he was killed in action in Afghanistan June 2, 2013. He was 39, his widow, 36. The loss of her husband meant the loss of a future with him - and any chance of having the children they'd tried for.

“I felt like my heart literally broke. When I was alone that night, my chest physically hurt,” Nancy says. “Every day was like living in a fog. I couldn't remember the simplest details. I would be driving, lose track of time, and miss my turn going home. … I cried from the moment I woke up. I cried in the shower, cried while I got ready and drove to work. I cried all the way home. I cried at night until … my eyes were swollen every morning.”

Complicating and compounding her grief was more shocking news: The so-called “widows tax,” which means surviving military spouses forfeit part or all of their SBP annuity when military service causes the member's death. In plain numbers, the offset meant Nancy would receive just 26 percent of the income Sean - a Green Beret with 18 years of service - had provided the household before he was killed.

“I'm a CPA. I have a business degree. Yet I can't tell you how vulnerable I felt when his pay was gone,” Nancy says. “Somehow, Congress thinks we 'got enough,' and they aren't willing to prioritize funding to help ensure that financial hardship isn't added on top of all the other daily struggles we are trying to overcome.

“My husband gave so much of his life and our marriage to this country, and he believed in it. He believed so strongly that he wouldn't just die for me or for his teammates, but he would die for all of us. He paid plenty. Our country can do better.”

Paula and Jim Spear (photos courtesy of Paula Spear)

'We Are Discarded'

In his last weeks of life, retired Army officer Jim Spear offered a final reassurance to his wife of 44 years. He had rechecked the SBP benefit, he told Paula Spear, who he still called “my beautiful bride.” The figure he recited would be enough for her to live on comfortably, as they'd planned.

Days later, Jim slipped into a coma and never woke. He died Oct. 26, 2014, due to complications from Agent Orange that had so compromised his system he could not receive full treatment for the pancreatic cancer that ultimately claimed his life.

Once a member of a classified special operations unit that received the Presidential Unit Citation for extraordinary heroism in action, Jim was a shadow of his former self at the end of his life, Paula says.

They met in Saigon in 1968, nine weeks before the Tet Offensive and days after Paula, a civilian with DoD, arrived in the warzone. The handsome intelligence officer was dining in a French restaurant with his unit when he recognized her; they'd crossed paths in Korea during an overlapping assignment two years before.

“I am convinced that fate - or a higher power - intervened this time,” Paula says.

They married a year later. In 1974, Jim was assigned to the U.S. Embassy in Tehran, where he issued prescient warnings about the security risks and imminent fall of the shah. He retired from the Army in 1977; the Spears started a market and economic research firm. That same year, Jim began suffering from severe gastrointestinal upsets.

“We spent years going to different doctors as the symptoms mounted,” Paula says. “They finally culminated in pancreatic cancer.” They closed the firm, and Paula, with no prior nursing experience, cared for her husband around the clock; one home care nurse said she was doing the work of four.

Jim was buried at Arlington National Cemetery, Va. Paula experienced a gut punch when she learned about the SBP-DIC offset that would cost her $1,200 a month - money she'd counted on. The $310 Special Survivor Indemnity Allowance felt like more of an insult than an offering.

The Spears had carefully planned for the future, and Paula worked into her 70s by choice. Now she is dipping monthly into a modest retirement account and looking for a job to make ends meet.

“My husband's belief that DoD had his back, after encouraging him to enroll in the annuity with [no] mention of the offset, was for naught,” Paula says. “We are discarded, while every other federal survivor segment is honored with fair treatment and receives concurrent benefits. It is the equivalent of leaving both Jim and me on the battlefield.”

Learn More about the Widows Tax

Under current law, survivors of deceased military members must forfeit part or all of their purchased Survivor Benefit Plan (SBP) annuity when they are awarded the VA's Dependency and Indemnity Compensation (DIC). The loss of any portion of the SBP annuity is known as the widows tax. For approximately 66,000 military survivors, the widows tax makes SBP the only insurance product in the country that you pay into but are legally prohibited from collecting.

To learn more about the effects of the widows tax visit www.moaa.org/Storming2019. To join the fight against the widows tax, send your legislators a MOAA-suggested letter.